A prediction market bet against Sanders

Lately, I've been enjoying playing around with prediction making and prediction markets.

I had a good time last week with the Iowa Caucus. Some of my co-workers noticed that the PredictIt market for "Who will win the 2016 Iowa Republican caucuses?" was substantially over-estimating Trump's chances. Better still, there was a sweet contract on "Will Donald Trump place 2nd in the 2016 Iowa Republican caucuses?" with "Yes" shares trading at $0.23 during the afternoon before the caucus. Cruz was the only other candidate with a plausible case for winning the caucuses, so "Will Trump place 2nd?" seemed nearly equivalent to "Will Cruz win?". A 23% chance of a Cruz victory seemed low given Cruz's strong ground game in Iowa and the tendency of polls to inflate Trump's support.

So, after quickly creating a PredictIt account and dumping in $100 from my credit card, I bought 330 shares of "Yes" on the "Trump 2nd" contract (at an average of $0.2345/share for a total of $77.40).

Even better, when the first caucus results started coming, "Yes" shares dropped to $0.17 (I think the very early results looked favorable for Trump). Panicking at this point and selling would have been a mistake, so I doubled down and bought more shares at $0.17 and $0.18 with the rest of my initial PredictIt deposit.

By the end of the evening it was clear that Cruz had won the caucus. Rubio came uncomfortably close to Trump (23.1% to 24.3%), which I didn't expect. I hadn't thought through Rubio's chances prior to making my bets, so that's a lesson for next time. Happily, Trump maintained his 2nd-place position, and all my shares cashed in at about $1 each (I sold some at $0.98 and $0.99 before the market closed because I wanted to cash in somewhat even if Rubio took second in the end). Total cash-in: $308.82. Not too shabby.

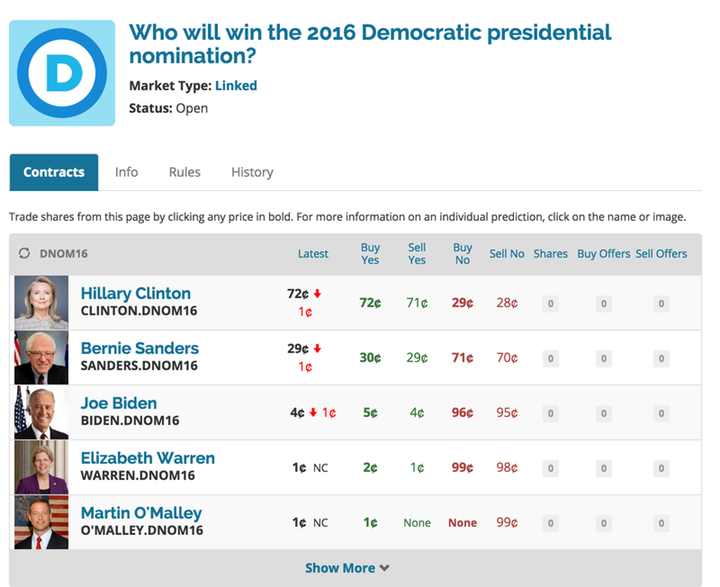

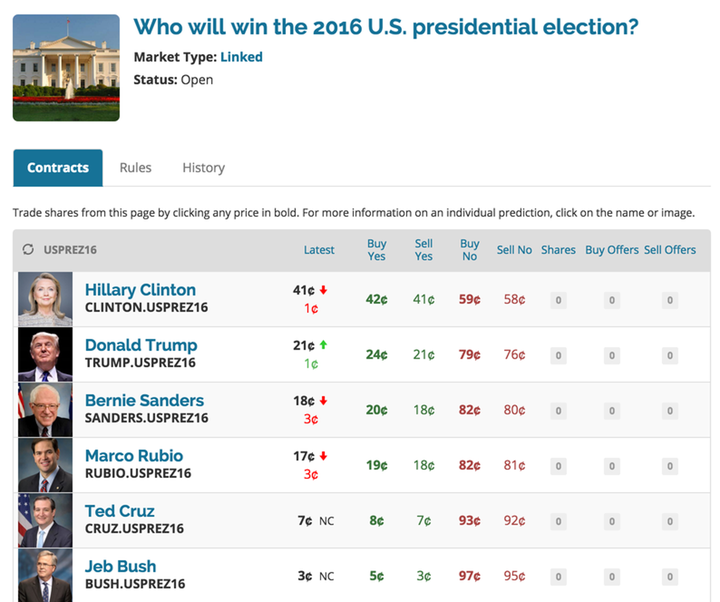

In a Slack conversation today, a co-worker observed another apparent misvaluation on PredicitIt: the probability of Bernie Sanders winning the Democratic Nomination was trading at $0.3, while the probability of Sanders winning the presidential election itself was trading at $0.18.

Here are the trading screens:

Because the event "Sanders wins prez election" depends heavily on the event "Sanders wins D. Nom", we can calculate the conditional probability "Sanders wins prez election given Sanders wins the D. Nom" using the market probabilities:

p(Sanders wins prez election | Sanders wins D. Nom) = 0.18 / 0.3 = 0.6

The market probabilities imply a 60% chance of Sanders winning the presidency if he wins the nomination! Which seems crazy – this is the candidate who tries to thoughtfully explain that he is a democratic socialist when asked on national television, and candidates who thoughtfully explain that they are socialists do not have a 60% chance of winning an American presidential election.

So, the market is overvaluing Sanders – how do we capitalize on that? A simple approach is to plug a reasonable p(Sanders prez | Sanders dnom) value into the equation and see what it spits out for p(Sanders prez). Let's assume that in reality p(Sanders prez | Sanders dnom) = 0.2 (this is conservative; the actual probability is probably much lower). Keeping p(Sanders dnom) steady at 0.3, this yields:

p(Sanders prez) = p(Sanders prez | dnom) * p(Sanders dnom) = 0.2 * 0.3 = 0.06

With these assumptions, Sanders has a 6% chance of winning the presidency. The market is overvaluing him by at least 3x, and these are conservative assumptions! Both p(Sanders prez) and p(Sanders dnom) are likely lower than the values used above.

At the time I made my bet, "No" shares on "Will Sanders win the presidential election?" were trading at $0.81. There is probably a clever way to figure out how many shares a rational agent would buy, but I took the crude approach and sunk nearly all the liquid money in my account into "No" shares (400 shares for a total of $324). My plan is to sell these for a nice profit after the market adjusts downwards. I could make a maximum return of 23% if I held them to contract end, but I suspect I'll want the liquidity before that.

Also, after I ordered I noticed that I had made a mistake – I should have used most of the money I was planning to commit now (maybe 1/2 or 2/3rds of the money I was planning to commit? not sure), then have used the rest after the New Hampshire primary this week. Bernie is strong in New Hampshire, and my guess is that his market p(Prez) will inflate further after the primary. Maybe I'll add some more money to my account...

[rereads: 1, edits: phrasing tweaks]